Fact-checking FactCheck.org’s comments on Bush’s proposed Social Security reforms

Unfortunately, FactCheck.org’s recent analysis of Bush’s proposed Social Security reforms, and whether Bush’s comments regarding SS reform in his State of the Union Address were accurate or fair, is flawed. Their analysis has a few false statements. A few times it unconvincing insinuates that Bush is withholding essential information about the consequences of his reforms when—in my view, anyway—this “withheld” information seemed perfectly obvious to me.

In FactCheck.org’s defense, their analysis doesn’t assign motives, evil or otherwise, to Bush or his statements. That’s good, objectivity means not pretending to have the ability to mind read. That being said, I discern that the person or persons who conducted this analysis are biased against Bush’s Social Security reform and this bias warped their analysis.

I will show that what FactCheck.org has produced is a political attack that is cross-dressed as a “neutral” analysis.

OK, let’s get started. Here is FactCheck.org on Social Security reform:

FactCheck.org’s point, that Bush didn’t specify “what workers would have to give up to get those private accounts” and that the worker would have to give up a “proportional reduction or offset in guaranteed Social Security retirement benefits” is a little disingenuous. I’ll play my response straight anyway.

Summary

In his State of the Union Address, President Bush said again that the Social Security system is headed for "bankruptcy," a term that could give the wrong idea. Actually, even if it goes "bankrupt" a few decades from now, the system would still be able to pay about three-quarters of the benefits now promised.

Bush also made his proposed private Social Security accounts sound like a sure thing, which they are not. He said they "will" grow fast enough to provide a better return than the present system. History suggests that will be so, but nobody can predict what stock and bond markets will do in the future.

Bush left out any mention of what workers would have to give up to get those private accounts -- a proportional reduction or offset in guaranteed Social Security retirement benefits.[emphasis mine—johnh] He also glossed over the fact that money in private accounts would be "owned" by workers only in a very limited sense -- under strict conditions which the President referred to as "guidelines." Many retirees, and possibly the vast majority, wouldn't be able to touch their Social Security nest egg directly, even after retirement, because the government would take some or all of it back and convert it to a stream of payments guaranteed for life.

First of all, and I don’t think I’m the only one, I thought it was obvious that personal accounts were a partial exchange for some—but not all—Social Security benefits. Put another way, it is very commonplace to give up one thing in order to get another and it seemed obvious to me that this was another one of those cases.

Also, it is difficult to me to understand how anybody could logically conclude that this plan could ever be expected to:

- Divert FICA withholding tax from Social Security, and

- gradually correct Social Security’s fiscal imbalance

unless the reforms also reduced everybody’s load on the system. To be pedantic, reducing the load on Social Security can only mean that everyone draws less money from it.

That’s why personal accounts were selected as a way out of this mess in the first place: they reduce the Social Security system’s load.

Bruce Bartlett writes more lucidly on this subject than I do. Here is some of his commentary:

I have heard more than a few people discuss Social Security reform as if the private accounts will magically fix Social Security without any necessity of reducing benefits. Indeed, they are adamant that there not be any cut in benefits whatsoever, now or any time in the future.

Obviously, such a position is ludicrous. The whole point of creating private accounts has always been as part of a trade-off. Workers would lose future Social Security benefits, which is what stabilizes the system's finances, and the income earned on the accounts will compensate them for this loss.

In order to induce people to make this trade-off, Bush strongly emphasizes that the status quo is unsustainable in the long run. He points often to the fact that the Social Security trust fund will be exhausted in the year 2042. At that point, current projected revenues from the payroll tax will only cover about 75 percent of promised benefits. The implication is that benefits will either have to be cut across the board by 25 percent or the payroll tax rate will have to rise by about 4 percentage points.

I’m going to address FactCheck.org’s second point, the one about “many retirees … wouldn’t be able to touch their nest egg directly” and so on, later in this post.

Now we’ll pick up in the analysis where we left off.

analysis

Bush made Social Security the centerpiece of his Feb. 3 State of the Union address. He gave more details of how he proposes to change the system -- but left out facts that don't help his case.

Social Security "Headed Toward Bankruptcy?"

The President painted a dire picture of Social Security's finances:

Bush: The system, however, on its current path, is headed toward bankruptcy . And so we must join together to strengthen and save Social Security.

"Bankruptcy" is a scary term that Democrats have used too, when it suited them, but it could easily give the wrong idea. Nobody is predicting that Social Security will go out of business the way a bankrupt business does. It would continue to pay benefits -- just not as many.

The President was a little more specific about that later in his address, while repeating the word "bankrupt":

Bush: By the year 2042, the entire system would be exhausted and bankrupt . If steps are not taken to avert that outcome, the only solutions would be dramatically higher taxes, massive new borrowing, or sudden and severe cuts in Social Security benefits or other government programs.

But how severe would those benefit cuts be? In fact there are two official projections -- one by the Social Security Administration (SSA) and a somewhat less pessimistic projection by the Congressional Budget Office (CBO). The President referred to the SSA projection, which calculates that the system's trust fund will be depleted in 2042. After that, the system would have legal authority to pay only 73 percent of currently promised benefits -- and that figure would decline each year after, reaching 68 percent in the year 2075.

The CBO doesn't project trust-fund depletion until a decade later, in 2052, and figures that the benefits cuts wouldn't be so severe, a reduction to 78% of promised benefits. But either way, even a "bankrupt" system would continue to provide most of what's promised currently.

OK, lets stop the tape here. FactCheck.org shopped around and found an organization, the Congressional Budget Office (CBO), that has arrived at a slightly different conclusion: ten whole years. This means that the CBO basically agrees with the Bush administration in general but has a minor disagreement about the time line.

By the way, arriving at different conclusions is easy if you just plug in slightly different assumptions into your models. In these sorts of political fights both the “hawks” (i.e., the pro-SS reform folks) and “doves” (i.e., the anti-SS reform folks) will plug in defensible assumptions that are selected because they yield the results that favor their arguments. The truth is probably between the extremes and I suspect that it is much closer to Bush’s position. Of course this is just my opinion since I don’t have the talent to do my own calculations.

Now regarding the CBO’s assertion that a 78% reduction of promised benefits would be needed as opposed to the administration’s 73% guess: this dispute is over only a 5% difference between the President and his critics. In my view, either reduction is a whole lot worse than Bush’s plan, which calls for a 0% reduction.

Furthermore, the President did not specify what he would do to fix the problem. He again urged creation of private Social Security accounts. But those would be of no help whatsoever in shoring up the system's finances, as acknowledged earlier in the day by a senior Bush administration official who briefed reporters on condition of anonymity:

"Senior Administration Official:" So in a long-term sense, the personal accounts would have a net neutral effect on the fiscal situation of the Social Security and on the federal government.

Well, I have to say that I’m astounded that FactCheck.org understood that the “Senior Administration Official’s” statement, “the personal accounts would have a net neutral effect on the fiscal situation of the Social Security”, to mean that personal accounts “would be of no help whatsoever in shoring up the [Social Security] system's finances”!

Think about this for a minute: FactCheck.org would have us believe that the Bush administration is conceding, up front, that Social Security reform can be expected to temporarily incur a huge deficit, expose investors to some slight risk that they will experience some loss and, at the end of the day, the Social Security system will be fiscally no better off than it is now. Put another way, FactCheck.org is saying that Bush intends on spending enormous political capital and cause the nation to take on a huge temporary deficit so as to accomplish nothing!

Simply put, the implications of their statement are unbelievable.

The following is a quote from a transcript of the "Background Press Briefing on Social Security," [pdf] which occurred on 2 Feb 2005. This is the same transcript that FactCheck.org has taken their quotes from. I’ve shown the sentence fragment quoted by FactCheck.org within the context of the two paragraphs where it was located. These paragraphs clearly shows that whatever “net neutral effect on [Social Security’s] fiscal situation” might mean, it cannot mean that Social Security’s fiscal dilemma is unimproved.

With respect to the fiscal effects of the personal accounts, in a long-term sense -- and I know those of you who have talked to me have heard me say this before -- but in the long-term sense, obviously, the personal accounts, as we would structure them, would not create a net new cost for the system. To the extent that people put money in these accounts and invest in these accounts, there would be a corresponding reduction in the government's liabilities from the Social Security system that is equal in present value to the money placed in the personal accounts up front. So in a long-term sense, the personal accounts would have a net neutral effect on the fiscal situation of the Social Security and on the federal government.

I would hasten to point out that this is distinct from something like an add-on account, where under an add-on account you actually would have a net new cost because you would have -- you would require resources up front to fund the accounts, but the accounts, themselves, would be creating additional -- or would be a part of an additional program or additional obligations on top of the current Social Security system, rather than addressing existing obligations. So an add-on account would add to the net cost of the system, but the accounts as we are envisioning them would actually be no net cost for the system over time.

My reading of these paragraphs leads me to conclude that the “Senior Administration Official” was trying to say that introducing personal accounts would have a “net neutral effect” with respect to costs to the existing system. Personal accounts would have a “net neutral effect” with respect to costs to the existing system because the liabilities of personal accounts are borne by the private sector.

That being said, the language used in these two paragraphs is not as clear as it could be. This is probably because it is a transcript of a person speaking rather than a written text. When people write they have a chance to review their language and edit or otherwise polish their prose; transcripts are unpolishable.

The “Senior Administration Official” added some confusion when he said, in the same paragraph, “To the extent that people put money in these accounts and invest in these accounts, there would be a corresponding reduction in the government's liabilities” and “personal accounts would have a net neutral effect on the fiscal situation of the Social Security and on the federal government.” To my way of thinking, when the “Senior Administration Official” asserted that personal accounts would both cause a “reduction in the government's liabilities” and have a “a net neutral effect on the fiscal situation of the Social Security, it made the first paragraph to seem incoherent. I say “incoherent” because I understand “net neutral effect” to mean “no change in the long run”.

It is the second of the two quoted paragraphs that shows that the “Senior Administration Official” (Bush?) was probably alluding to the fact that personal accounts would add “no net cost [to] the system over time.”

In light of these two paragraphs, I find it difficult to understand how FactCheck.org could justify their assertion that a senior Bush administration official “acknowledged” that personal accounts wouldn’t “shore up” the Social Security system’s finances. I conclude that FactCheck.org is being either deliberately deceptive or is way too slapdash to be in the fact-checking business.

OK, now back to FactCheck.org’s analysis.

And that "net neutral effect" is just over the long term, 75 years or more. In the shorter term, creation of private accounts would require heavy federal borrowing to finance the payment of benefits to current retirees while some portion of payroll taxes is being diverted to workers' private accounts. The administration projects it will borrow $754 billion (including interest) through 2015 to finance the initial phase-in of the accounts, and much more thereafter. The liberal Center on Budget and Policy Priorities -- which opposes Bush's proposal -- projected that $4.5 trillion (with a "t") would be required to finance the first 20 years of the accounts after they start to be phased-in in 2009.

OK, FactCheck.org is noting that the “hawks” and “doves” are forecasting very different peak debts to be incurred by Bush’s proposals. It is prudent to guess that reality is somewhere between these two extremes. To their credit, FactCheck.org did point out that the high estimate was manufactured by Bush’s leftist opposition.

The problem with the deficit spending is that too much of it will threaten the Dollar’s standing as the world’s currency by making the Dollar weaker. Also it means that the U.S. must pay a higher interest on bonds and so on. This worries me.

A friend of mine, Tom G, pointed out that the Treasury would receive a windfall of revenues when the baby-boomers begin to retire and cash in their 401K’s and other tax-deferred investment schemes. He said that the current rules for estimating future deficits are not allowed to factor in such considerations. If true then this means that these deficit projections are inflated to some degree—who knows how much—for procedural reasons.

My thinking is that we should consider increasing tax rates to mitigate the coming deficits. I also reason that since private accounts will increase the annual GNP by a percent or so then the treasury should be receiving additional tax revenues anyway. In effect, the personal accounts will contribute to paying for their transition costs.

Yes, I know, the existing Social Security system could be saved if we are willing to pay additional taxes, so the question becomes "why not just do it that way?" My answer is that I don’t think the existing Social Security system is worth paying higher taxes for and the personal accounts are. Put another way, I think personal accounts are worth the trouble and cost to transition to them.

Private Accounts: A Sure Thing?

The President made those private accounts -- which he now prefers to call "personal" accounts -- sound like a sure bet:Bush: Here's why the personal accounts are a better deal. Your money will grow, over time, at a greater rate than anything the current system can deliver -- and your account will provide money for retirement over and above the check you will receive from Social Security.

History suggests that the President is correct -- the stock market has averaged a 6.8 percent "real" rate of return (adjusted for inflation) over the past two centuries, according to Jeremy Siegel, professor of finance at the University of Pennsylvania's Wharton School. The administration says a conservative mix of stocks, corporate bonds and government bonds would return 4.6 percent, even after inflation and administrative costs. And the administration also figures that private accounts would need to generate only a 3 percent rate of return to beat what Social Security provides.

But there's no guarantee that history will repeat itself. Markets are inherently unpredictable and volatile. At present, for example, all major stock-market indexes are still well below where they were five years ago.

In this quote, FactCheck.org uses data provided by Wharton finance professor Jeremy Siegel. Here FactCheck.org points out that Jeremy Siegel has calculated that the U.S. stock market has averaged a 6.8 percent “real” (i.e., adjusted for inflation) rate of return over the last two centuries.

Here is Jeremy Siegel

…stocks are the most profitable long-term investment – providing a premium that offsets stocks’ greater short-term risks relative to bonds and cash. From 1802 through 2003, the broad stock market provided “real” returns – adjusted for inflation – averaging 6.8 percent a year. “On average, you have doubled your purchasing power every decade in the stock market,” he said during his talk, adding that while stocks have failed to meet that average over a few long periods, performance has been remarkably consistent.

The downturn that began when the tech-stock bubble burst in 2000 merely returned the market to normal patterns following a period, from 1981 through 1999, of outsized returns – 13.6 percent a year. “We are right on the trend line,” he said.

Siegel has long argued that stocks should form the core of most small investors’ retirement portfolios….

I’ve discussed Jeremy Siegel and his calculations regarding stock market returns at length elsewhere. Jeremy Siegel has produced several stock market return calculations and I believe they are all correct. I noticed, however, that FactCheck.org selected the calculation that shows the lowest percentage return to quote. Selecting the lowest number is useful as a political weapon because it makes personal accounts seem less attractive. Not there is anything wrong with quoting a low-ball figure, per se, but FactCheck.org should have mitigated the unfairly negative impression it created with other data available from the same authority that FactCheck.org cited.

Finally, regarding FactCheck.org comment:

But there's no guarantee that history will repeat itself. Markets are inherently unpredictable and volatile. At present, for example, all major stock-market indexes are still well below where they were five years ago.

This statement has one true and one false statement. First, FactCheck.org let us know that markets fluctuate; true. Second, it is simply not true that “all major stock-market indexes are still well below where they were five years ago”.

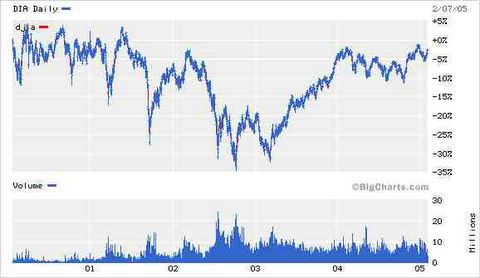

I’ll address FactCheck.org’s false “fact” first. The Dow Jones industrial index is unarguably a “major stock market index”. Figure 1 is a chart showing the most recent five years of the Dow Jones industrial index, from February 2000 to February 2005. The Dow Jones Industrial Index, after five years—which includes the burst of the dot com bubble and the outbreak war on September 11th—is down only a few percentage points. The same chart makes it obvious that this index was positive as recent as summer of 2001 with respect to February 2000.

Figure 1. Chart of the Dow Jones Industrial Index for the last five years

I find it inexplicable how FactCheck.org could make such a gross error on such an easily verified fact.

OK, now to the “fact” that FactCheck.org got right: that markets will fluctuate. There are two points that need to be made regarding market fluctuations. First, nobody denies that markets fluctuate. For the purposes of personal accounts, investing in the stock market only makes sense in the long run and five years is way too short-run to make any sense. Second, this phenomenon is why folks 55 and older will not be allowed to have personal accounts when the SS reforms are launched. Private accounts need time to recover from stock market reverses and folks who are 55 and older cannot count on having enough time for their personal accounts to recover before they retire.

I would have thought the folks at FactCheck.org should have understood this.

OK, I guess I beat those two paragraphs into the ground. On to the next one.

Benefit Offsets

The President made no mention of one crucial aspect of the proposed accounts -- anyone choosing one would also have to give up an offsetting portion of their future guaranteed retirement benefits. If their investments in private accounts returned more than 3 percent annually over the years, they would end up better off than under the current formula. But if those investments did worse, they wouldn't make up for the portion of benefits that were given up, and the owner of an account would end up worse off. The President didn't explain that trade-off.

Well I don’t think I’m the only one, but I thought that this was an obvious tradeoff. Does anyone actually need to have that explained to them?

The other point is that is worth reciting is that personal accounts’ risks are so low—and returns so high—that they make SS look like a poor investment.

"The Money is Yours?"

The President also glossed over some severely restrictive aspects of the accounts he is proposing, saying flatly "the money is yours."

Bush: In addition, you'll be able to pass along the money that accumulates in your personal account, if you wish, to your children and -- or grandchildren. And best of all, the money in the account is yours, and the government can never take it away .

That's not exactly true.

As described by the "senior administration official," the owners of personal accounts wouldn't be able to touch the money while they are working, not even to borrow. The money would remain in the hands of the federal government, which would administer the personal accounts for a fee which the official said would be about 30 cents per year for every $100 invested.

And even at retirement, the government would control what becomes of the money. First, the government would automatically take back a portion of the money at retirement and convert it to a guaranteed stream of payments for life -- an annuity. The amount taken back -- called the "clawback," descriptively enough -- would depend on the amount of money the retiree requires to remain above the official poverty guideline. That's currently $12,490 for a couple or $9,310 for a single person. Only after the combination of traditional Social Security benefits and the mandatory annuity payments from the private account equal the poverty level would any remaining portion in the account be "yours."

OK, FactCheck.org finally gave me some information that I didn’t know. I didn’t know what would happen to the personal account’s money at retirement.

FactCheck.org is saying several things:

1. You cannot access your personal account for any reason until you retire. Not even for medical emergencies.Regarding issue 1: you cannot access your personal account for any reason until you retire.

2. The goverment will charge you a 0.3% annual fee to manage your personal account

3. At the time of your retirement, the goverment will use part of your personal account to purchase an annuity for you. The income from the annuity, together with your Social Security payout, will guarantee that in the worst case your income will remain above the poverty line. There is a slight risk that the personal account will not have enough money to completely pay for the annuity.

4. Any residual personal account money leftover after the purchase of the annuity is turned over to the owner of the personal account.

This is reasonable. You cannot access your Social Security account until you retire either, so you’re no worse off in that regard.

Preventing citizens from frittering their nest egg away guarantees that the government’s will always be able to keep its promise that the retirement scheme will be able to perform when citizens retire.

Regarding issue 2: the government will charge a 0.3% annual fee for managing your personal account. This is similar to the management fees for an index fund. For example the Vanguard 500, a S&P 500 index fund, has annual costs of roughly 0.18% while Morgan Stanley’s S&P 500 index fund has annual costs of about 1.5%. (In my view, 1.5% is steep by index fund standards.) Mutual funds charge much more. In summary, a 0.3% administration fee is quite an attractive deal and is comparable to the low cost management fees charged by index funds.

Regarding issue 3: The government will take back a part of your personal account when you retire.

The hostile tone in the phrases “take back” or clawback is misleading. The money “taken back” will immediately be used to purchase an annuity for you. This annuity is your property because you paid for it. The annuity, when combined with your Social Security, guarantees that our retiree’s incomes will be above the poverty line. In theory this means no more poor elderly.

Regarding issue 4: The money remaining in the personal account after the purchase of the annuity is turned over to the account owner. (Party!)

Put another way, at retirement the account owner receives the portion of the personal account remaining after the purchase of the annuity.

At one level, FactCheck.org seems to be insinuating that the money in the personal account is something less than the property of the account’s owner. The subtitle for this section, “The Money is Yours?”, sounds like the it was designed to undermine the reader’s confidence that they would “own” the money.

FactCheck.org also resorted to scare quotes. Scare quotes are a literary device used by writers to distance themselves from the scare-quoted text because they believe the text is inappropriate for some reason. Consider, for example, of how FactCheck.org employed scare quotes in the following sentence: ‘Only after the combination of traditional Social Security benefits and the mandatory annuity payments from the private account equal the poverty level would any remaining portion in the account be "yours."’ In this case FactCheck.org was sending a message suggesting that whatever the money in the personal account might be, they didn’t think you should considered it “yours”.

Now there is no evidence that either FactCheck.org or myself can use to justify the idea that a personal account's money doesn’t belong to the account’s owner, but that didn’t inhibit FactCheck.org from signaling that it might not.

OK, there’s only a small bit of FactCheck.org’s analysis remaining and it mostly recites material from that press briefing without saying anything interesting. I’m skipping over the rest of their analysis.

Summary:

The plan proposed by Bush provides an income sufficient to keep retirees above the poverty line. Retirees receive 100% of their personal account at the time of retirement, either as an annuity or as cash.

Before I go on I want to point out a general principle: Social Security is not intended to provide a comfortable retirement. Put another way, Social Security is not enough to “live” on but too much to starve.

Everybody should understand this up front. Everybody should make provisions for their retirement. It is their responsibility to do this and nobody else.

Social Security is a safety net that prevents the old from starving if something goes terribly wrong in their lives, are unable to work the normal 40 years so as to save for their retirement or—perhaps—are just too irresponsible to save for their retirement

The SS reforms only affects people 55 or younger so most people have plenty of time to figure out a retirement plan before the first people retire under this plan.

Nobody can make me feel guilty because it only guarantees a just-above poverty level income.

OK, that should be sufficient troll repellent. Not that I have any of them or anything.

Conceivable problems.

There is a risk that inflation will diminish the annuities purchasing power. There are two types of annuities: fixed and inflation adjusted. I would think that the annuity would be the inflation adjusted variety. I haven't heard which type it will be, however.

In effect, the private accounts are paid for by the deficit we will incur as we transition to private accounts. Fundementally, borrowing is usually a dumb way to get investment money. I’m troubled by it. On the other hand, the alternatives are worse.

The current average monthly benefit for Social Security retirees is $955 a month, only $200 above the $755 needed for a poverty-line income. This is according to an article on MSBC, “Dissecting the president's Social Security plan”. The President's plan is clearly, on the average, a reduction, from the current SS payout. I say again, anyone with a working brain will have implemented their own retirement plan to supplement the goverment's retirment plan.

FactCheck.org’s scorecard:

They made disingenuous arguments that insinuated Bush was being deceptive about Social Security reform. This was a dishonest technique.They insinuated that the money in personal account will somehow not fully be “yours”. More dishonesty.

They seemed to make much out of a 5% difference between Bush’s estimate for how much SS benefits would have to be cut, if nothing else was done, and the CBO’s estimate I guess they were trying to manufacture a talking point.

They Dowdified an administration official such that he seem to be saying that SS reform will not cure Social Security’s fiscal problems. Now this is contemptible misconduct. I don’t like liars and FactCheck.org has damaged its reputation for veracity.

They made a blatantly false statement when they stated that all major stock marketed indexes are still well below where they were a year ago. This also builds FactCheck.org’s reputation for lying.

They pointed out that the Bush Administration and the “doves” have very different estimates of the peak deficit caused by SS reform. This is OK. This sort of data should be on the table.

All in all, I have to say I was disgusted with FactCheck.org’s conduct. They have shown themselves to not be a neutral fact checking organization; at least as far as Social Security reform is concerned.

<< Home